Mundell's two country model for macroeconomic interdependence

With increased world integration there was a need to study the transmission of policy in one part of the world to other country's. The complex pattern of economic linkages led to the development of several models describing transmission mechanisms. Mundell Fleming's (MF) model was one amongst those.

The model discusses 3 channels of interdependence:

1. Marginal propensity to import

2. Interest rates

3. Exchange rates (under flexible regime)

MF model has been used to argue that an economy cannot sustain simultaneously a fixed exchange rate, free capital mobility and an independent monetary policy. This principle is also known as the impossible trinity.

Assumptions:

1. Two country's: Home and foreign. Also, both the countries are similar, therefore symmetricity exists.

2. Perfect capital mobility. UIP hods

3. Adaptive expectations. So, the expected change in exchange rates is zero

4. Prices are fixed

5. Marshall-Lerner conditions hold

6. The output is determined by demand

Flexible exchange rates

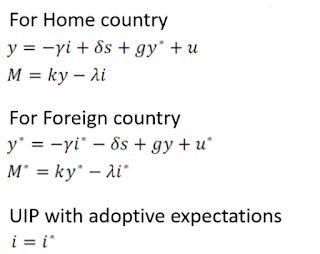

AD is given by IS-LM conditions. Equations of the model, therefore, are:

The model is converted into (y,y*) space. The equations for home and foreign country transforms to:

1. Effect of fiscal policy:

The model discusses 3 channels of interdependence:

1. Marginal propensity to import

2. Interest rates

3. Exchange rates (under flexible regime)

MF model has been used to argue that an economy cannot sustain simultaneously a fixed exchange rate, free capital mobility and an independent monetary policy. This principle is also known as the impossible trinity.

Assumptions:

1. Two country's: Home and foreign. Also, both the countries are similar, therefore symmetricity exists.

2. Perfect capital mobility. UIP hods

3. Adaptive expectations. So, the expected change in exchange rates is zero

4. Prices are fixed

5. Marshall-Lerner conditions hold

6. The output is determined by demand

Flexible exchange rates

AD is given by IS-LM conditions. Equations of the model, therefore, are:

The model is converted into (y,y*) space. The equations for home and foreign country transforms to:

1. Effect of fiscal policy:

We observe that the expansionary policy in a foreign country has an expansionary effect in the home country or positive spillover.

a. Marginal propensity to import: expansionary

Increase in AD in a foreign country falls over to home country due to the trade channel and therefore increases exports of the home country.

b. Interest rates: contractionary.

Since the money supply is constant, an increase in y will need to be complemented with an increase in i.

c. Exchange rates (under flexible regime): expansionary.

This is because the change in y and y* is the same. However, in domestic IS, gy* is small, thus delta*s increases in order to increase y to the same level as y*. Thus, we have nominal depreciation or real depreciation.

b. Interest rates: contractionary

c. Exchange rate: expansionary

Fixed exchange rates

Equations of the model are:

The model is converted into (y,y*) space. The equations for home and foreign country transforms to:

a. Marginal propensity to import: expansionary

b. Interest rates: contractionary

We observe that the expansionary policy in a foreign country has an expansionary effect in the home country or positive spillover.

a. Marginal propensity to import: contractionary

b. Interest rates: contractionary

We observe that the contractionary policy in a foreign country has a contractionary effect in the home country or negative spillover.

a. Marginal propensity to import: contractionary

b. Interest rates: contractionary

Increase in AD in a foreign country falls over to home country due to the trade channel and therefore increases exports of the home country.

b. Interest rates: contractionary.

Since the money supply is constant, an increase in y will need to be complemented with an increase in i.

c. Exchange rates (under flexible regime): expansionary.

This is because the change in y and y* is the same. However, in domestic IS, gy* is small, thus delta*s increases in order to increase y to the same level as y*. Thus, we have nominal depreciation or real depreciation.

2. Effect of monetary policy:

We observe that the contractionary policy in a foreign country has an expansionary effect in the home country or positive spillover.

a. Marginal propensity to import: contractionaryc. Exchange rate: expansionary

Fixed exchange rates

Equations of the model are:

The model is converted into (y,y*) space. The equations for home and foreign country transforms to:

1. Effect of fiscal policy:

We observe that the expansionary policy in a foreign country has a contractionary effect in the home country or negative spillover.

a. Marginal propensity to import: expansionary

b. Interest rates: contractionary

We observe that the expansionary policy in a foreign country has an expansionary effect in the home country or positive spillover.

2. Effect of monetary policy (D*):

We observe that the contractionary policy in a foreign country has a contractionary effect in the home country or negative spillover. a. Marginal propensity to import: contractionary

b. Interest rates: contractionary

We observe that the contractionary policy in a foreign country has a contractionary effect in the home country or negative spillover.

a. Marginal propensity to import: contractionary

b. Interest rates: contractionary

In nutshell

Comments

Post a Comment