Long-Run Model in Macroeconomics

As we had seen, in the short and medium run fluctuations (shocks and policy changes) dominate. In the long-run capital accumulation and technological change dominates. In the very long run, technological change dominates.

Growth is related to the rate of change of per capita GDP over a long period of time. "Economic growth" is often used generically to refer to increases in living standards. Looking across countries, we want to know how much higher the standard of living is in one country than in another. Thus, the variable we want to focus on and compare either over time or across countries is output per person rather than output itself. The growth rate of GDP per capita in the US is constant over the long run at 1.9% per annum.

What matters for peoples welfare is their consumption rather than their income. One might, therefore, want to use consumption per person rather than output per person as a measure of the standard of living. Because the ratio of consumption to output is rather similar across countries, the ranking of countries is roughly the same whether we use consumption per person or output per person.

Thinking about the production side, the appropriate measure is output per worker. Output per person and output per worker will differ to the extent that the ratio of the number of workers (or hours) to population differs across countries.

Growth rates typically change over time.

Growth is related to the rate of change of per capita GDP over a long period of time. "Economic growth" is often used generically to refer to increases in living standards. Looking across countries, we want to know how much higher the standard of living is in one country than in another. Thus, the variable we want to focus on and compare either over time or across countries is output per person rather than output itself. The growth rate of GDP per capita in the US is constant over the long run at 1.9% per annum.

What matters for peoples welfare is their consumption rather than their income. One might, therefore, want to use consumption per person rather than output per person as a measure of the standard of living. Because the ratio of consumption to output is rather similar across countries, the ranking of countries is roughly the same whether we use consumption per person or output per person.

Thinking about the production side, the appropriate measure is output per worker. Output per person and output per worker will differ to the extent that the ratio of the number of workers (or hours) to population differs across countries.

Growth rates typically change over time.

The evolution of output per person since 1950s for rich countries shows that there has been a large increase in output per person and also there has been a convergence of output per person across countries.

We have observed the convergence of output per capita for different regions. However, the phenomenon is not worldwide. As we see that many Asian countries are rapidly catching up, but most African countries have both very low levels of output per capita and low growth rates.

SOLOW GROWTH MODEL WITH NO TECHNICAL PROGRESS

At the centre of the determination of output, in the long run, are two relations between output and capital:

1. The amount of capital determines the amount of output being produced

2. The amount of output determines the amount of saving and, in turn, the amount of capital accumulated over time

Assumptions:

1. Closed economy

2. Two inputs in production: K and N

3. Constant returns to scale in both inputs, and decreasing returns in each input.

4. The size of the population, the participation rate and the unemployment rate are all constant. We take this assumption to focus on how capital accumulation affects growth.

Let's discuss the first relation firstly,

So, in the model, we have production (Y), capital (K), labour (L).

The aggregate production function is Y = F(K,N)

We have constant returns to scale in K, N, that is, zY = F(zK, zN)

The equation can be transformed into per capita terms, so we have, Y/N = F(K/N, N/N) or, y = f(k)

Note: capital letters denote level, small letters denote per capita.

Thus higher capital leads to higher output per worker.

Also, we have diminishing returns to scale in k.

So, y is affected by the inflow of capital (delta_k, positive) and the outflow of capital (delta_k, negative). This neoclassical model (with no technological progress) describes the conditions for growth in output per worker as a function of the capital intensity (k=K/N), also called as the capital-labour ratio.

To derive the second relation, between output and capital accumulation, we proceed in two steps:

1. We derive the relation between output and investment

2. We derive the relation between investment and capital accumulation

The first step: The capital intensity (stock of K relative to the stock of workers) is determined by the difference between the inflow and outflow of capital per worker. The neoclassical growth model describes the conditions for growth in the potential production and income per capita (income can differ from this in S/R - business cycle). As the economy is in equilibrium at potential income, the model describes the conditions for growth in equilibrium income per capita.

Equilibrium income, assuming public saving is zero and c0 as zero, we get, Y = c1*Y + I => s1*Y = I, where s1 is the marginal propensity to save (s1 = 1-c1) and I is the investment. So, higher output implies higher saving and, thus, higher investment.

The second step: The second step relates investment, which is a flow (the new machines produced and new plants built during a given period) to capital, which is stock (the existing machines and plants in the economy at a point in time).

Now, as discussed output per worker is y = f(k)

The inflow of capital per worker (delta_k, positive) is equal to the investment per person, that is, savings per person: I/N = i = sf(k).

Similarly, the outflow of capital per worker (delta_k, negative) is depreciation, that is, capital per person times the depreciation rate: d = delta*k, where delta belongs to (0,1)

So, the net capital inflow is capital inflow - capital outflow, or, sf(k) - delta*k.

The capital intensity (the stock) increases when net capital inflow is positive and decreases when the net capital inflow is negative.

So the capital per worker evolves over time in the following way,

End of period capital intensity = Beginning of period capital intensity + capital inflow - capital outflow. In words, the change in capital stock per worker is equal to saving per worker minus depreciation.

Thus we have seen from the production side how capital determines output. From the savings side, we have seen how output determines capital accumulation.

At k0, capital is low, investment exceeds depreciation (blue>green) and k increases. At k1, capital is high, depreciation exceeds investment (green<blue), and k decreases. At k*, y and k remain constant at their long-run equilibrium levels (green=blue).

Remember our y_n, the natural rate of output which we discussed in medium run models. That y_n, as we see here can change with capital intensity and settles in the long run at y*. So, y* is the steady-state income per worker and k* is the steady-state capital intensity. At steady state consumption c* = y*-i*, or as we can see that, c* = f(k*) - delta*k*

Output per worker, y = f(k), which implies that g_y = f(g_k),

where g_y is the growth rate of output per capita and g_k is the growth rate of capital per capita (capital intensity).

At steady state, y* = f(k*). Now, as we had seen from the graph, g(k*) = 0, since inflow of capital, equals outflow of capital, so, g(y*) = 0. So, the growth rate of output per capita is zero in the steady state (the equilibrium). This does not mean that there is no capital accumulation, the new capital is needed to replace the worn out capital, but they are equal to each other.

Because of decreasing returns to capital, capital accumulation by itself cannot sustain growth. The savings rate has no effect on the long-run growth rate of output per worker, which is equal to zero. We have seen that, eventually, the economy converges to a constant level of output per worker. Nonetheless, the savings rate determines the level of output per worker in the long run. Also, an increase in the savings rate will lead to higher growth of output per worker for some time, but not forever.

Sustained growth requires sustained technological progress. The rate of growth of output per capita is eventually determined by the economy's rate of technological progress. (Solow model)

SOLOW GROWTH MODEL WITH TECHNICAL PROGRESS

Technical progress leads to increases in output for given amounts of capital and labour. Assuming labour augmenting technological progress, the aggregate production function becomes, Y = F(K, AN).

This production function has constant returns to scale in K and AN (effective labour). Output per unit of effective labour can then be written as, Y/AN = f(K/AN,1), or, y_an = f(k_an)

This production function has diminishing returns in k_an or capital per effective worker.

In this case, I = S = sY, so we have, I/AN = sY/AN or i_an = sf(k_an). So, the inflow of capital per effective worker (delta_k_an) is,

In the previous model, for capital to be constant, investment had to be equal to the depreciation of the existing capital stock. Here, however, the answer is slightly complicated. Now that we allow for technological progress, the number of effective workers, AN, increases over time. Thus, maintaining the same ratio of capital to effective workers, K/AN, requires an increase in capital stock K, proportional to the increase in the number of effective workers, AN. Unlike in the previous case, we allow for the growth of labour and therefore, we need to define g_n and g_a as,

g_n + g_a = growth rate of effective labour, AN. Therefore, the level of investment needed to maintain a constant level of capital per unit of effective labour (AN) equals,

So, the outflow of capital per effective worker (delta_k_an, negative) equals,

So, the net capital can be written as,

Capital and output per effective worker converge to constant values in the long run.

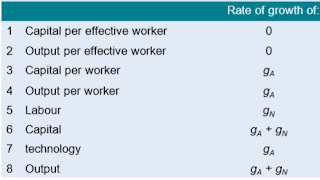

Since, y_an = g_y - g_a = 0, so at steady state we have g_y = g_a, or,

Output per capita grows at the same rate as technology. This would be basically the slope of log(GDP)'s vs time curve's slope that we had witnessed in previous topics.

Suppose the savings rate in the economy increases. Then we see that the level of output per effective worker increases in the long run. Growth of output per effective worker is, however, unchanged.

The increase in the saving rate leads to higher growth until the economy reaches its new, higher, balanced growth path.

In a nutshell, in the long run, equilibrium, the characteristics of balanced growth are,

Problems with the neoclassical growth models:

1. DRS to capital means that once an economy reaches the steady state it stops growing in per capita terms. The only way to sustain growth can be achieved through technological progress.

2. The model, however, does not really explain what are the determinants of the technological progress (g_a is exogenous)

3. It does not explain the lack of convergence for most pooer economies.

4. Suggests that differences in per capita income are due to differences in K. In practice H (human capital) also plays an important role.

In modern economies, technological progress is the result of firms research and development (R&D). Spending on R&D depends on:

1. The fertility of the research process, that is, on how spending on R&D translated into new ideas and new products.

2. The appropriability of research results, that is, on the extent to which firms benefit from the results of their own R&D.

Comments

Post a Comment