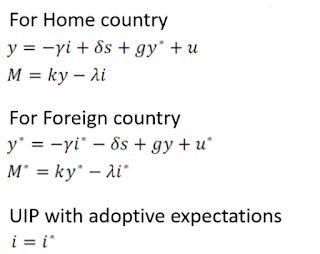

Unlike Mundel Flemming model, this model introduces dynamics. Further, it takes the role of expectations into account. Dornbusch's model was highly influential because, at the time of writing, the world had recently shifted to a floating exchange rate regime and a little was understood about exchange rate volatilities.